The market rewarded impact investors in the second quarter.

Stocks fell on persistently high inflation in April amid concerns that the Fed may be forced to keep interest rates on hold for longer than previously expected. Even though the Fed has signaled only one rate cut is in the cards — up from an unhealthy three at the start of the quarter — stocks are on track to end the quarter in the green, thanks to improving inflation data and strong first-quarter earnings. Tossed again. The Americas Marketplace Index rose 3.48% in the second quarter and is now up 23.78% over the past year.

Under the hood, the fake understanding industry showed signs of slowing within the quarter, and tech stocks continued to dominate. Bond markets also closed the quarter higher in some areas, as investors gained confidence that inflation was improving. This reduced giveovers and added some value back to bondholders’ portfolios.

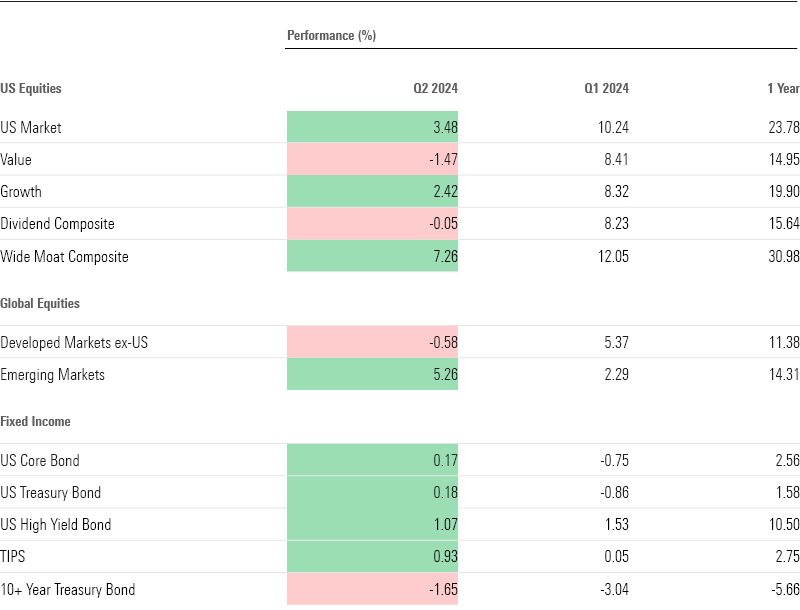

Key Statistics: Q2 2024 Keep and Bond Marketplace Efficiency

- The Americas Marketplace Index gained 3.48% in the second quarter, improving from a significant decline in April. Shares have gained 23.78% in the last one year.

- Megacap tech stocks led the market, with Nvidia NVDA contributing 1.6 percent to the market returns. The much-expected expansion of the rally into alternative areas did not occur.

- Worth shares once again lagged behind their strong growth data.

- Bonds finished the second quarter in the green with a slight margin, with the US core bond index up 0.17%. Business fell.

- Dividend stocks lagged the broader market, and Alphabet’s GOOGL/GOOG was the unheralded tech giant to declare its first dividend expense.

- The Fed kept interest rates safe. The market is now expecting a smaller September.

- The handover curve remained inverted.

- Oil prices fell, which helped control inflation. Meanwhile, copper prices rose by 8.51%.

- Bitcoin again lost record-breaking momentum in the first quarter.

maintain market efficiency

The beginning of the quarter was difficult for the market. There was a significant pullback in April, with shares falling 5.6% from their March high. After a strong jobs record, momentum changed during the year, and stocks were back in the green by mid-May. The positive aspects continued and the book market ended the quarter with a gain of 3.48%.

Like the first quarter, chipmaker Nvidia led the way at best. The AI giant gained 36.74% and is now up 200% over the 12-month period. Nvidia Unloved contributed 1.6 share points to the market return within the quarter.

The next biggest members were Apple AAPL, Microsoft MSFT and Alphabet – a sign that the long-awaited extension of the bull market beyond big tech has not succeeded. So far, strategists say these companies have met traders’ earnings and performance expectations, though they caution that with valuations rising, any missteps could send those stocks plunging.

The Large Motif Composite Index returned 7.26%, outperforming the US market by more than 5 share points. The index is made up of stocks that Morningstar analysts believe will have a long-term aggressive advantage over their peers. Its management holdings are Microsoft, Apple, Nvidia and Amazon AMZN – the same stocks that are riding the market’s explosive rally.

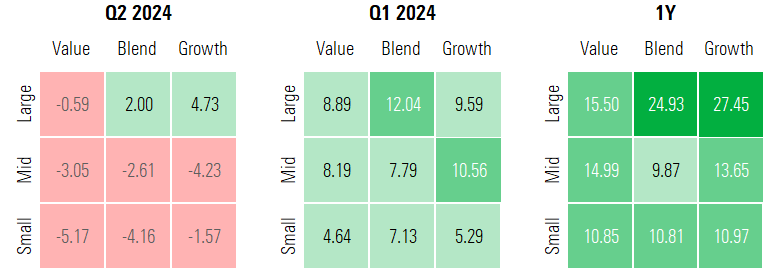

Worth Funnel vs Enlargement Funnel Efficiency

After outperforming growth stocks by a narrow margin in the first quarter, value stocks lagged in the second quarter. The US price index declined by 1.47%, while in comparison the US growth index gained 2.42%.

Across the flavor sector, only large-growth and large-blend stocks rose, reflecting the modest success of the rally. The biggest losers were small-cap value stocks, which fell 5.17%. On the other hand, during the one-year period, each class is still inexperienced.

Generation and communication stocks continued to dominate the market during the quarter. Tech shares rose 11.40%, with immediate verbal exchange seeing shares gain 9.16%. Defensive stocks were another bright spot, with Consumer Defensive up 1.11% and Utilities up 4.48%. Cyclical stocks declined across the board, with the most significant losses being in unfurnished clothing. Energy and business stocks declined and then posted double-digit gains in the first quarter. With interest rates at an all-time high, real estate stocks remained a target.

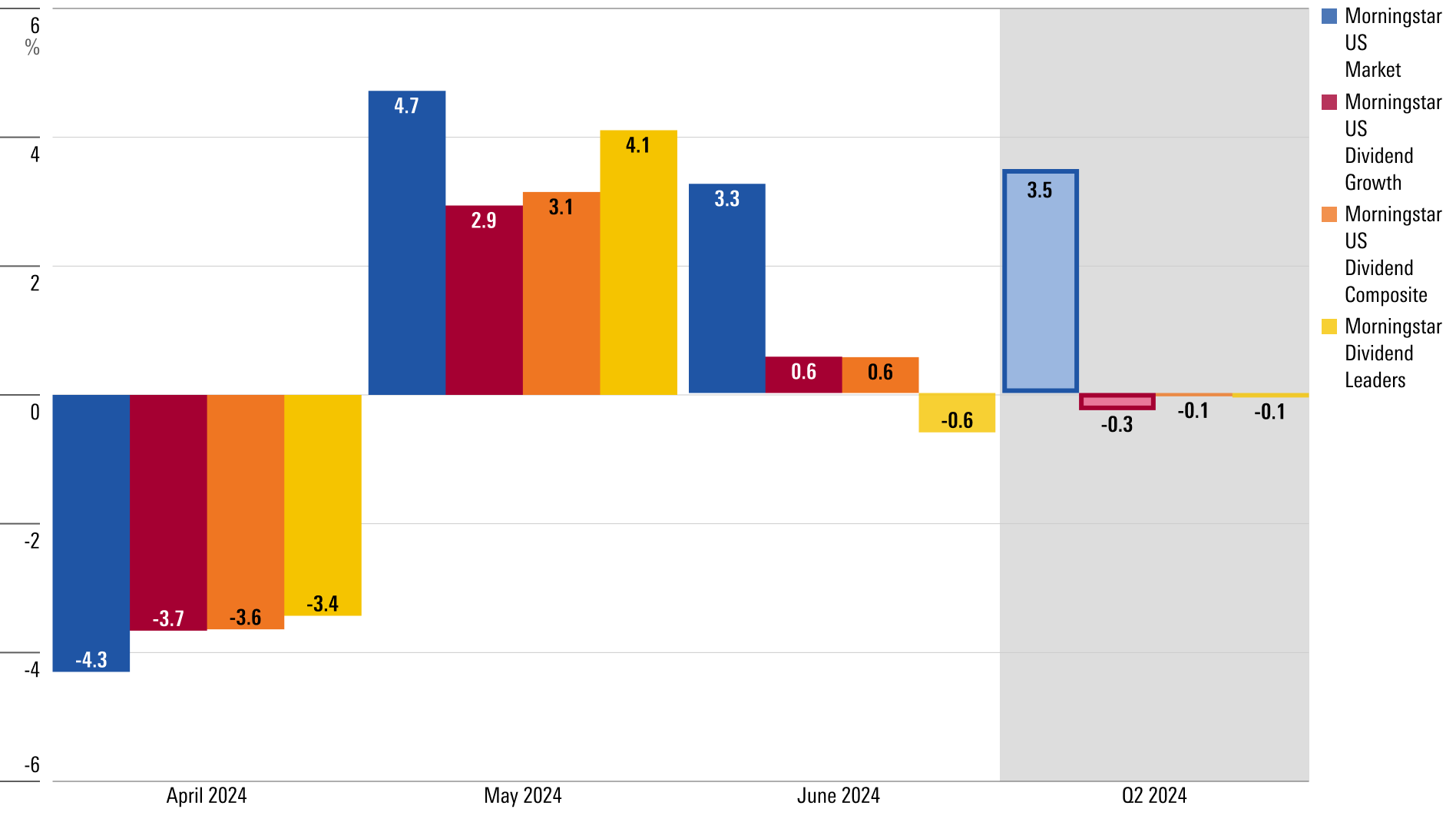

dividend retention efficiency

Dividend stocks continued to lag the broader market in the second quarter. The Dividend Composite Index ended the quarter down 0.1%, unable to overcome its April losses despite recording gains in May and June. The US Dividend Growth Index fell 0.3% while the Dividend Leaders Index fell 0.1%.

Alphabet announced its first dividend payment in April, joining a growing group of dividend-paying tech stocks that includes cloud platform Meta and Salesforce CRM. Strategists believe these mega-cap tech stocks currently have the potential to raise their dividends, but caution that the giveover remains quite low.

Market value hobby fee reduction in September

Market expectations for the then-current round of federal bonds to 2024 have changed dramatically. The Fed has kept interest rates safe at a target range of 5.25%-5.50% for nearly two years, and investors were anxiously looking for evidence that a rate cut might be around the corner.

Bond futures markets began pricing in six or seven cuts to 2024, but stronger-than-expected inflation data forced investors to dramatically revise that estimate. Now the market expects only one or two cuts this year. They see more or less 58% Anticipations for a 0.25-percentage-point easing at the Fed’s September meeting, according to the CME FedWatch tool.

Q2 2024 bond market efficiency

The bond market recovered in the second quarter, boosted by improving inflation and a less aggressive, more confident approach to tariff cuts. Turnover on the 10-year Treasury note has fallen more than 0.30 share points from its April peak, ending the quarter at 4.37%.

The reduction in giveovers means traders have some value open on their bond holdings. The core bond index gained 0.17% for the quarter, more or less with 0.18% Back to US Treasury bonds. Top-yield bonds saw a better gain of 1.07%, while longer-term returns lagged. With the cut in fees, strategists are expecting bonds to perform better.

Treasury turnover curve yet again inverted

Despite a turbulent few months in the bond markets, the handover curve inverted in the second quarter, with the size of handovers remaining roughly the same as at the end of the March quarter.

An inverted handover curve assigns more to temporary Treasuries than their long-term opposite numbers. This is always taken as a sign that investors are expecting the financial system to perform poorly in the coming months. It is also usually a precursor to a recession, although it is not an assurance. The handover curve has now been inverted for almost seven consecutive quarters – a surprisingly long current.

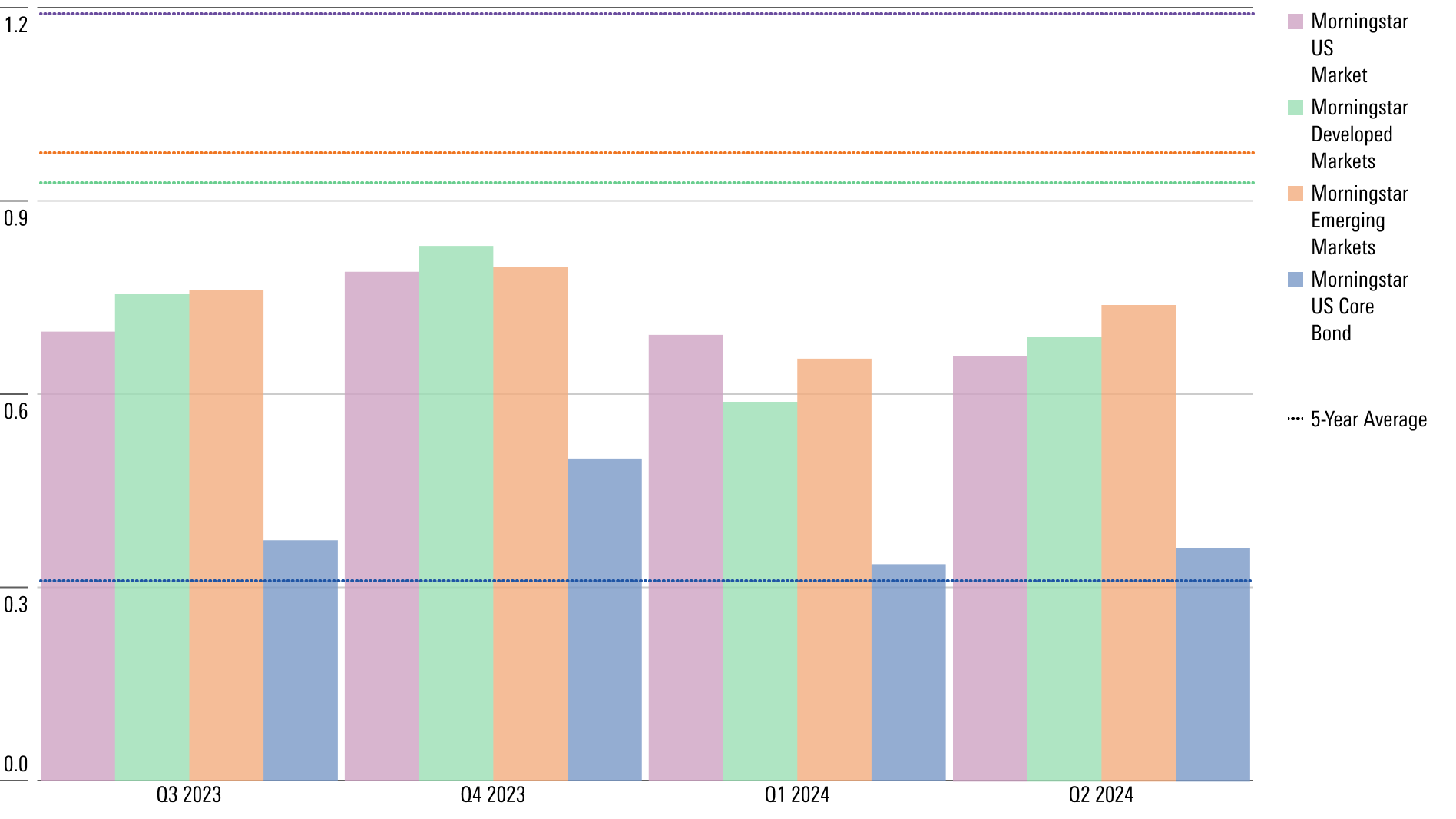

Put and bond market volatility

Volatility increased slightly from the first quarter but remained low compared to the traditional characteristics of the US book market, developed markets and emerging markets.

Bond market volatility remained above its five-year average and increased modestly from the first quarter, as investors readjusted their expectations of an interest rate cut from the Fed.

Q2 Best and Worst Marketplace Performers

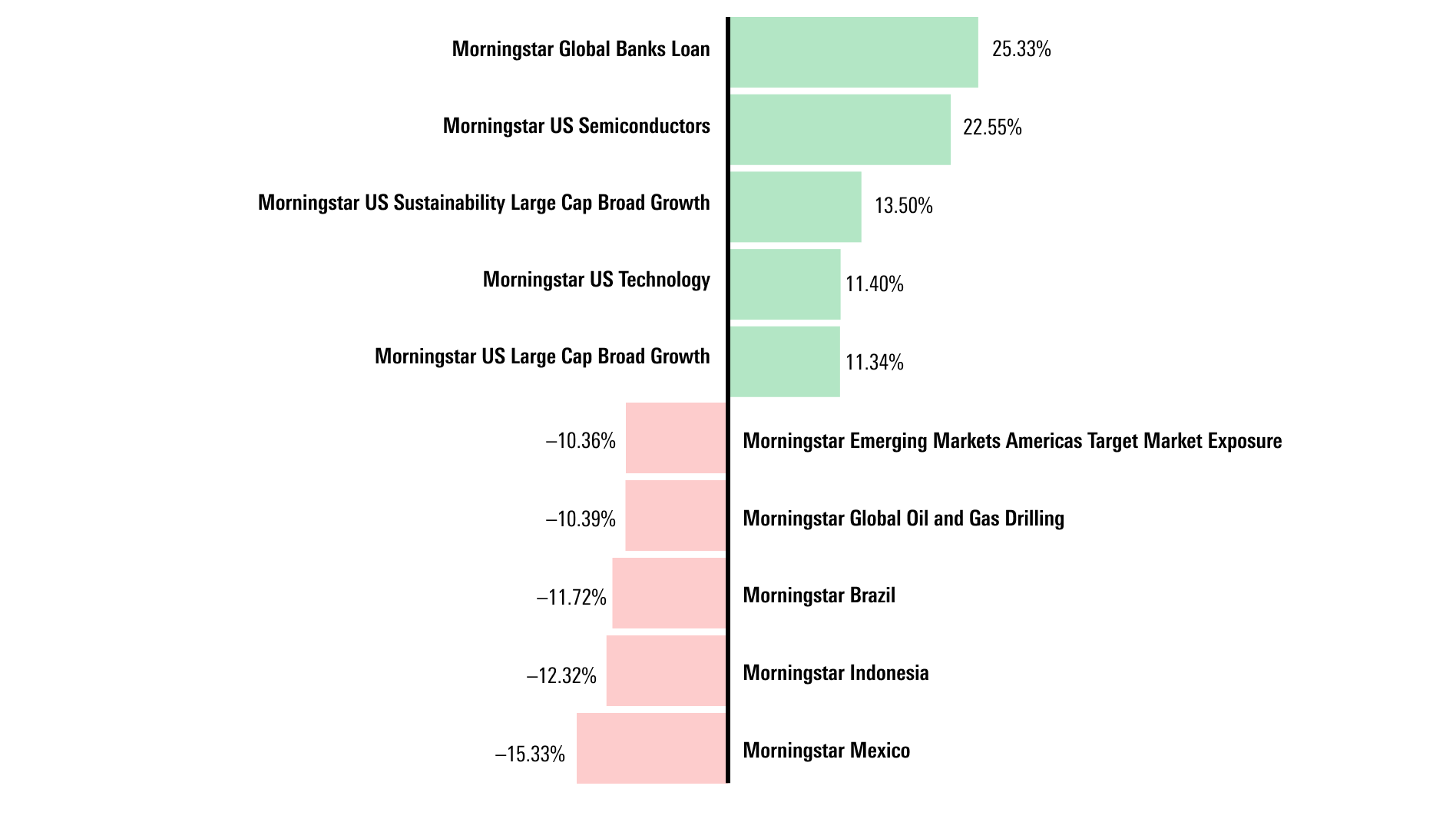

The market’s biggest gains in the second quarter came from semiconductors, with the US Semiconductor Index rising 22.55%. Due to Nvidia, which accounts for more than its share of the index by weight. Chipmaker Broadcom AVGO, which gained 21.53% in the quarter, accounted for the other 13.5%. Meanwhile, the International Bank Mortgage Index returned 25.33% Since interest rates remained high.

Mexican stocks struggled following the election of Claudia Sheinbaum to the country’s presidency, causing the Mexico index to lose 15.33% for the quarter, as investors worried that the meat presser’s policies could be harmful to business. Broadly, emerging markets struggled, with oil and gas stocks also falling as crude prices fell.

commodity market efficiency

WTI crude oil prices fell 2.59% in the second quarter, then gained more than 18% in the first months of the year. That change helped lower the cost of gas and alternative consumer goods.

Gold, which investors often use as a hedge against geopolitical or economic uncertainty, gained 4.08% in the quarter and again hit the highest level of listings in March.

Meanwhile, copper prices soared higher in April, posting gains of more than 25%, before easing again and ending the quarter at 8.51%. Copper is widely used in business processes and products, and its efficiency is widely recognized as a key indicator of the fitness of the global financial system.

Q2 2024 Cryptocurrency Efficiency

The crypto then struggled to post banner gains in the first quarter, when it was boosted by being at the mercy of the primary spot Bitcoin exchange-traded budget. Bitcoin ended the second quarter at more or less $60,000 according to Coin, which is 13.64% lower than its all-time peak of over $73,000 according to Coin in March. Ethereum, the second most prevalent cryptocurrency, ended the quarter down 5.57%.

Discover more from news2source

Subscribe to get the latest posts sent to your email.