Those generic drug manufacturers, seeking solace from price gouging campaigns, are serious about the opportunity to bring their generic drug ‘first to market’. This allows them to enjoy market exclusivity and make money for a limited period. Those companies are also trying to price optimize insurance policies to increase margins and increase the capacity of available sources.

Business Description

The scientific-generic drug industry consists of corporations that assemble and market chemically/biologically equivalent forms of a brand-name drug once the patent expires, providing exclusivity to the branded drug. Those drugs can also be divided into generic and biosimilar classes based on their structure. The generic sector is managed by a few giant drug manufacturers and generic devices of giant pharma companies. Many small companies also make generic versions of branded drugs, which are significantly cheaper than branded drugs. Competition in this sector is stiff impacting low margins for manufacturing corporations. Some companies in this industry have a few branded drugs in their portfolio, which helps them access the high-margin market.

3 characteristics shaping the timing of the generic drug business

Lack of patent exclusivity of branded medicine: Generic drug manufacturers basically depend on the lack of patent exclusivity of the branded drug. They pursue the FDA to approve their generic or biosimilar versions of branded drugs that have lost patent coverage. The patent expiration of a blockbuster drug like AbbVie’s Humira, which followed, provided significant opportunities for generic drugmakers like Amgen and Sandoz, which have already introduced their respective Humira-biosimilars. Another blockbuster drug set to suffer patent loss in the future is J&J’s Stelara, which is authorized in multiple immunology indications.

A company may launch a certified generic model of a branded product, thereby gaining exclusivity over alternative generic versions of the same drug for several months. This is great for generic gamers, especially when it comes to complex generics, which require significant R&D investment and experience compared to traditional generics. Those generic drug manufacturers also face litigation for bringing generic models of branded drugs to market.

Strict show: The generic drug business competes with untouched branded drugs. As soon as a branded medicine loses the patent exclusivity and generic versions of the same become available in the market, it inspires competition as the festival, I smartly price the generic below the price of the branded medicine. Because of this, drug manufacturers strive for first-to-file (FTF) status for drugs. The Tide generics market is already crowded, with several drugmakers having multiple generic filings pending before the FDA. I foresee a number of biosimilar drugs being launched over the next few years, with the potential for those companies to grow significantly at their peak.

Patent Settlement: Successful resolution of demanding patent situations is still an important catalyst for expansion of generic drug manufacturers. Settlement of those demanding conditions expedites the supply of cheap generic goods and eliminates the uncertainties associated with litigation. On the other hand, situations of energetic patent demand require litigation, which is important for increased prices.

The Zacks Trade Rank symbolizes shining prospects

The Zacks Scientific – Generic Medication Trade is a small 11-stock team based in the broader Zacks Scientific sector.

The Zacks Trade Rank of the gang is the normalization of the Zacks Rank of all member stocks. The Zacks Scientific – Generic Medicines industry holds a Zacks Trade Rank #86 these days, placing it within the top 34% of the Zacks 250 industries. Our analysis shows that the top 50% of Zacks-ranked industries outperform the base 50% by a factor of more than 2 to one.

Against the backdrop, we can offer some standout shares. But before that, it is important to take a look at the stock market performance of the industry and Tidal valuation.

Trade Outpaces Sectors and the S&P 500

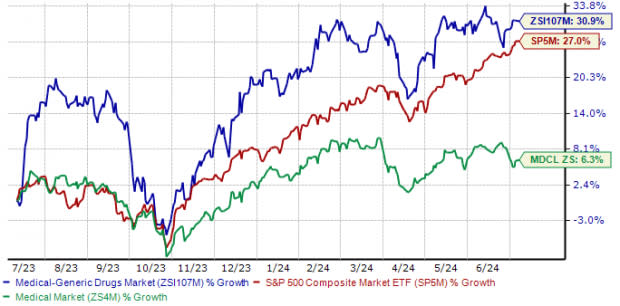

The Zacks Scientific – Generic Medicines industry outperformed the broader Zacks Scientific and S&P 500 indexes in future.

Trade expanded 30.9% over the period, compared with a 6.3% expansion for the broader sector. Meanwhile, the S&P 500 has gained 27.0% within the said time frame.

A future-worthy efficiency

Symbol Supply: Zacks Funding Analysis

trade wave valuation

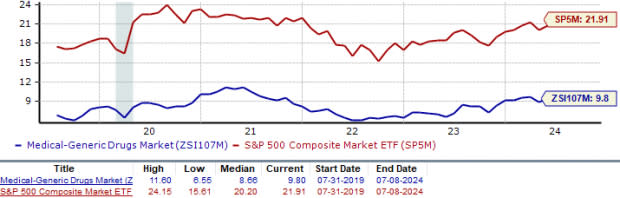

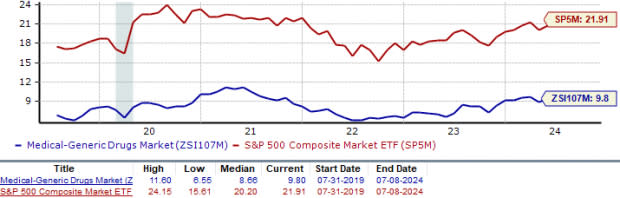

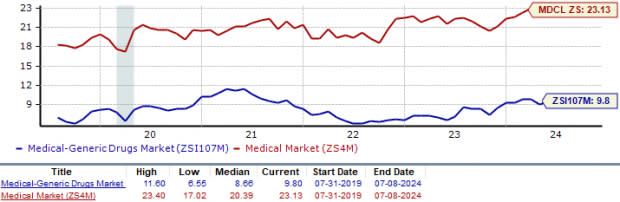

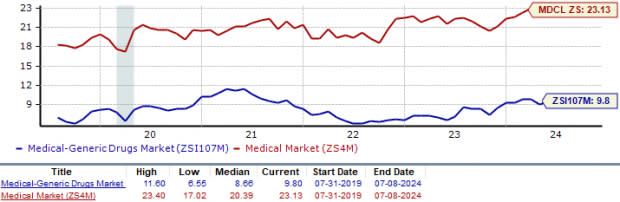

In response to the next one-year price-to-earnings (P/E F12M), which is more than once outdated for valuations of generic companies, the business is trading nowadays at 9.80X compared to the S&P 500’s 21.91X. . and the Zacks Scientific Sector Average of 23.13X.

Over the last five years, the exchange has traded at a maximum of 11.60X, a minimum of 6.55X and an average of 8.66X as per the chart below.

P/E F12M Ratio

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

3 generic drug shares to reserve vision

amphastar: The company is serious about expanding its portfolio of generics and biosimilars. In May, the company received FDA commendation for bringing to market a generic version of Teva’s ProHair HFA inhaler. Control plans to launch this generic product in the third quarter of 2024. As of May 22, 2024, the company has 3 generic drugs under review with the FDA. It is also developing 3 biosimilars and 4 generic drugs with significant market alternatives.

The company may be interested in selling higher-margin products, including the diabetes drug Baqsimi, which it later acquired from Eli Lilly.

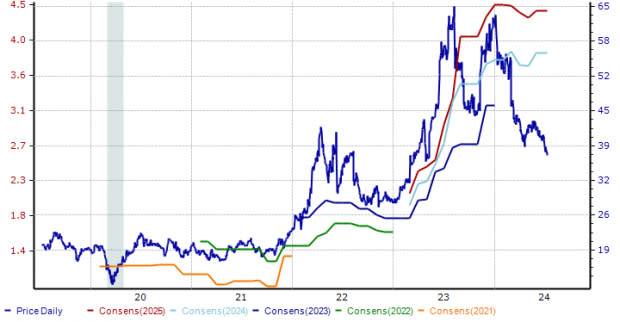

The stock has declined 32.8% in debt futures. The consensus estimate for 2024 revenues has increased from $3.81 to $3.86 according to the 60 day to date ratio.

Amphastar has a Zacks Rank #3 (Conserved). you will be able to see Here’s the full list of recent Zacks #1 Rank (Strong Buy) stocks,

Price and Consensus: AMPH

Symbol Supply: Zacks Funding Analysis

Teva: Teva is the largest generic pharmaceutical company in the region. The corporate enjoys a significant position in the US, the largest generics market in the region. Teva’s share of the US generics market is about 8%. Approximately 50% of Teva’s generics industry is outside the US, in Europe and emerging markets, where the company is driving forward-looking growth. Teva often pursues first-to-file and first-to-market options and seeks accolades for complex generics, which face less competition. This will help the company maintain its strong position in the global generics market.

During the first half of 2024, Teva managed to reserve FDA approval for two lead drugs, namely Simlandi and Selarsdi, which are biosimilar versions of the blockbuster immunology drug Humira and Stelara, respectively. Since the Humira biosimilar was commercially introduced in May, the Stelara biosimilar will be introduced later in February. Control hopes to launch six biosimilars by 2027.

Control expects that in addition to a strong generics business, its more modern drugs, Austedo, Uzedi and Ezovi, will help revive top-line expansion in the generation quarters.

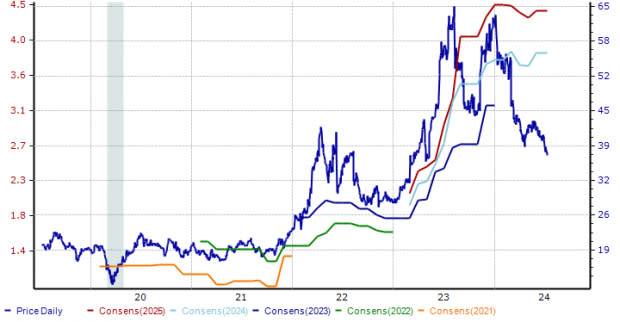

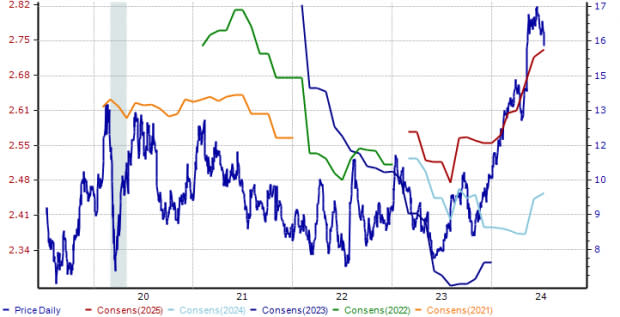

The consensus estimate for 2024 revenue has increased from $2.41 to $2.45 according to the 60 day to date ratio. The stock is up 94.5% year to date. TEVA has a Zacks Rank #3.

Value and Consensus: TEVA

Symbol Supply: Zacks Funding Analysis

Viatris: Viatris’s generics industry includes various product systems, such as extended-release oral solids, injectables, transdermals and topicals, which were performing better than expected due to large demand in the northern United States. The introduction of generic versions of Restasis and Revlimid, and overall FDA praise of generic Symbicort (Breyana) have boosted the company’s peak crease and should fuel expansion. Looking ahead, the company’s generics business was flat in 2023, and is expected to strengthen somewhat in 2024. Control has added several first-to-market generic product options such as Ozempic, Vegovy and Abilify Maintena.

The company’s branded industry, which comprises two-thirds of its portfolio, is performing well, with brands such as Yupelari, Lipitor and Donna utilizing the company’s top crease.

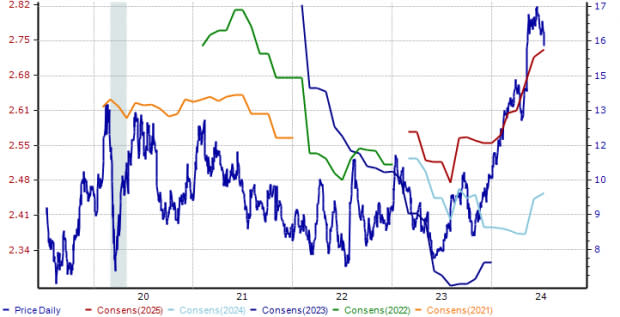

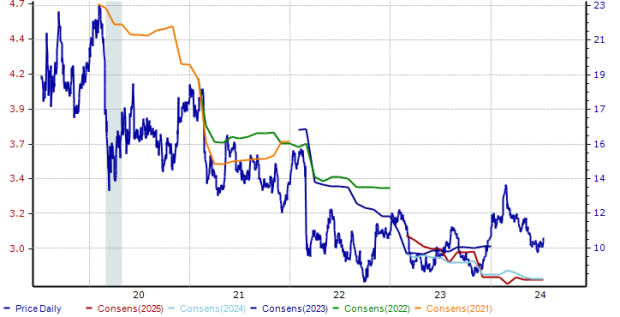

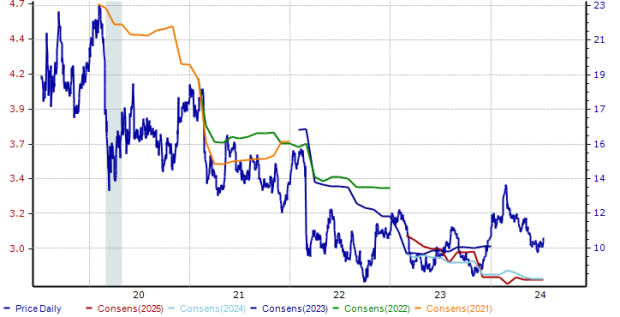

The stock is up 5.4% year to date. According to Ratio, the consensus estimate for 2024 revenues over 60 days remains stable at $2.76. Viatris is a Zacks Rank #3.

Value and Consensus: VTRS

Symbol Supply: Zacks Funding Analysis

Need unedited tips from Zacks Funding Analysis? These days, you will be able to get the 7 highest shares for the subsequent 30 days. Click to get this Sovereign File

Amphastar Prescribed Drugs, Inc. (AMPH): Detached Conserved Research File

Teva Pharmaceutical Industries Limited (TEVA): Detached Preserve Research File

Viatris Inc. (VTRS): Detached Preserve Research File

Click here to read this newsletter on Zacks.com.

Zacks Funding Analysis

Discover more from news2source

Subscribe to get the latest posts sent to your email.