I don’t want to discuss the main points of the story now because you know them. Accommodation costs upwards of a bundle. Loan fees are also higher than a bundle.

This is a true ultimatum.

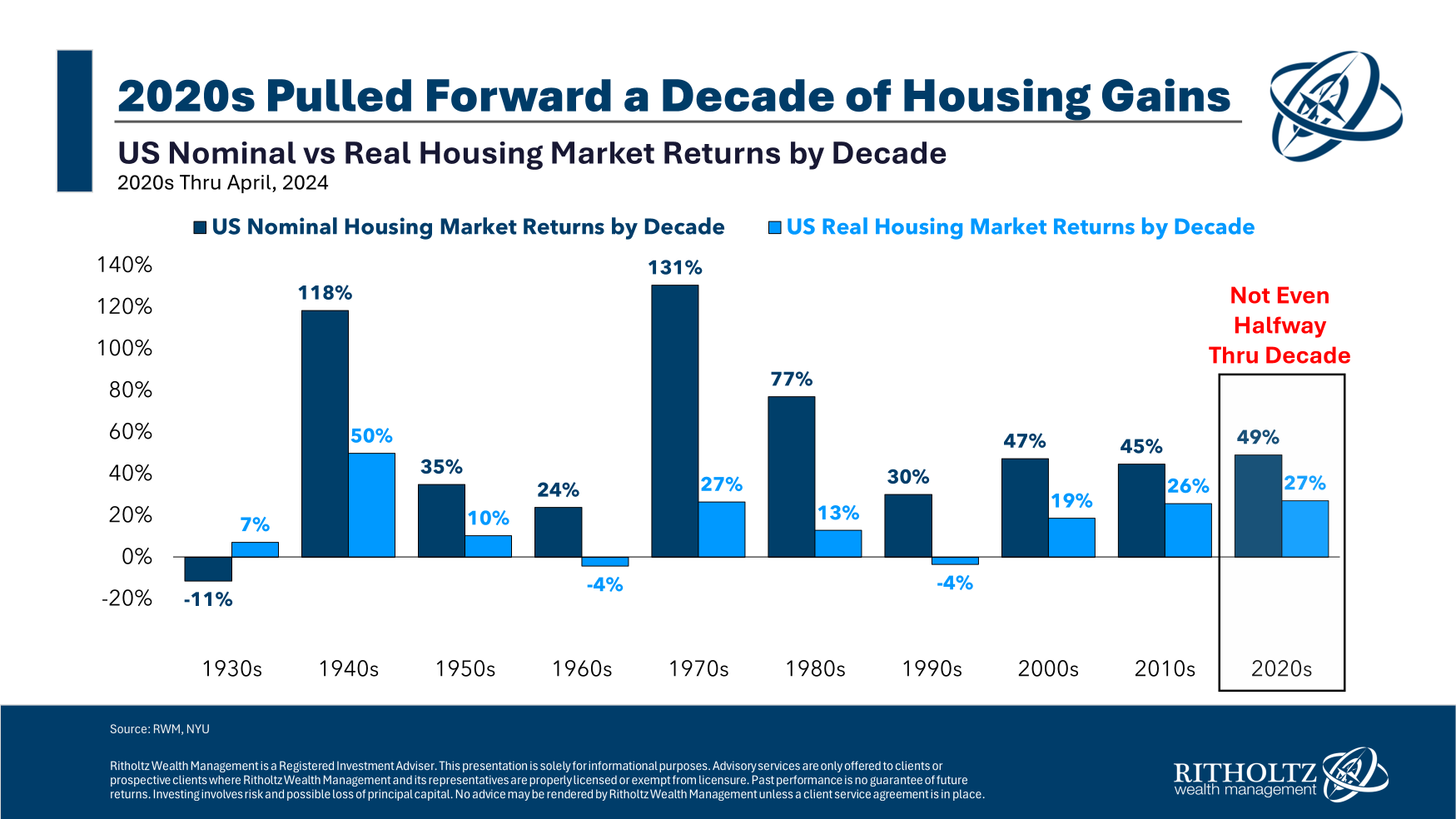

We essentially proceeded to characterize a decade of housing returns in the first few years of 2020:

The cost of housing in the 2020s has already reached higher levels than it has in years. On an inflation-adjusted basis, higher returns were only seen in the nineteen forties and we still have more than five years to go.

If I were a Wall Side Road pundit, I might say simple money has been made, although I don’t want to succumb to that temptation now.2

I don’t know if this is some kind of summit within the housing market. Looking at the positives, I wouldn’t be surprised if housing prices remained stable for a chance. Even a cost reduction wouldn’t be surprising.

My baseline assumption is that prices will remain somewhat close to the inflation rate in the coming years, but predictions about the month are meaningless. I don’t know where housing prices will go from here.

The vision of a summit in housing prices got me thinking about how disappointing this would be for people who are thinking about buying, promoting or living in their stream houses. The two conditions to be believed are listed below:

State of Affairs 1. The cost of housing has fallen by 20%.

State of Affairs 2. Housing costs are not rising any further than they have been for the remainder of the last decade.

How you feel about both of those situations will probably depend on your stream status or plans for the month.

From the perspective of anyone who plans to live in their home for the coming month (me), none of these situations make much of a difference.

Leaving aside the fact that a 20% drop in home prices would probably be due to some kind of financial situation, my home is worth a lot less than my everyday point of view.

As long as I continue to pay the loan, insurance coverage, and component taxes, if the cost of our place drops 20% the next day, my age will not change significantly. This will eliminate my ability to tap equity through the HELOC, although I no longer rely on it as a source of capital.

It can be nerve-wracking for a minute to see another person coming into our group and buying a spot on sale at a 20% discount. And possibly, it could be painful if we were forced to promote for some reason, although if that’s the case the entire alternative home would be 20% cheaper as well. We may be buying one asset at a higher cost and selling another asset at a lower cost.2

My internet virtue will be gone but not anymore as objectivity is fluid in my house anyway.

If prices aren’t moving anywhere near the residuals of the last decade, we’ve already experienced some positives moving forward this decade.

Anyone who has owned a home for many years knows it looks beautiful.

The homeowners who will feel the most pain in both of these situations will be the ones shopping nationwide right now.

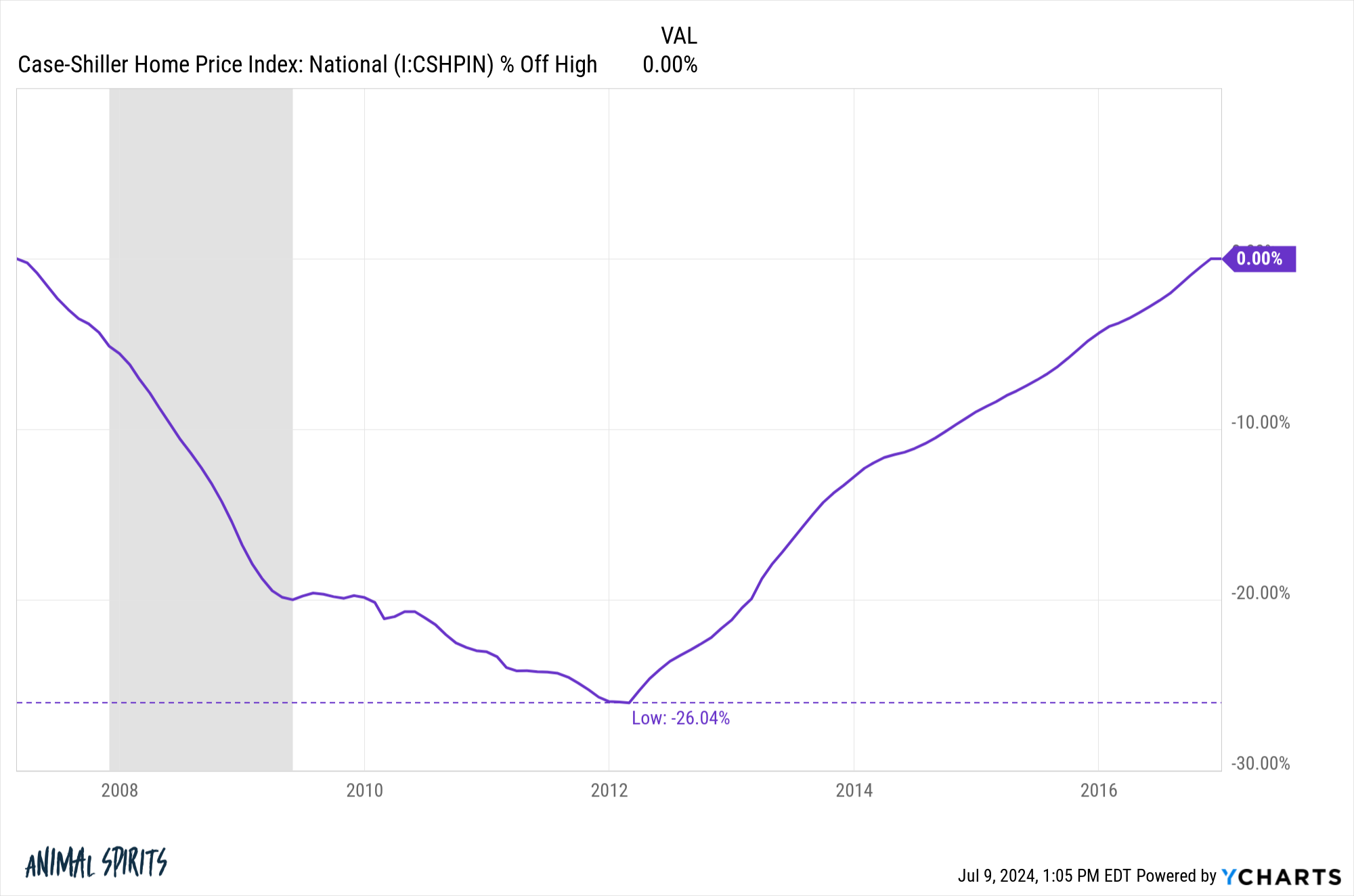

You don’t need to go that far into our country’s history to see this game. From the beginning of 2007 to the end of 2016, US housing costs have been underwater from their ancient highs during that time:

Prices fell by more than a quarter along the way.

More than 6 million unoccupied and existing properties were sold in 2007, so in effect most of the country’s housing market was again at its lowest point.

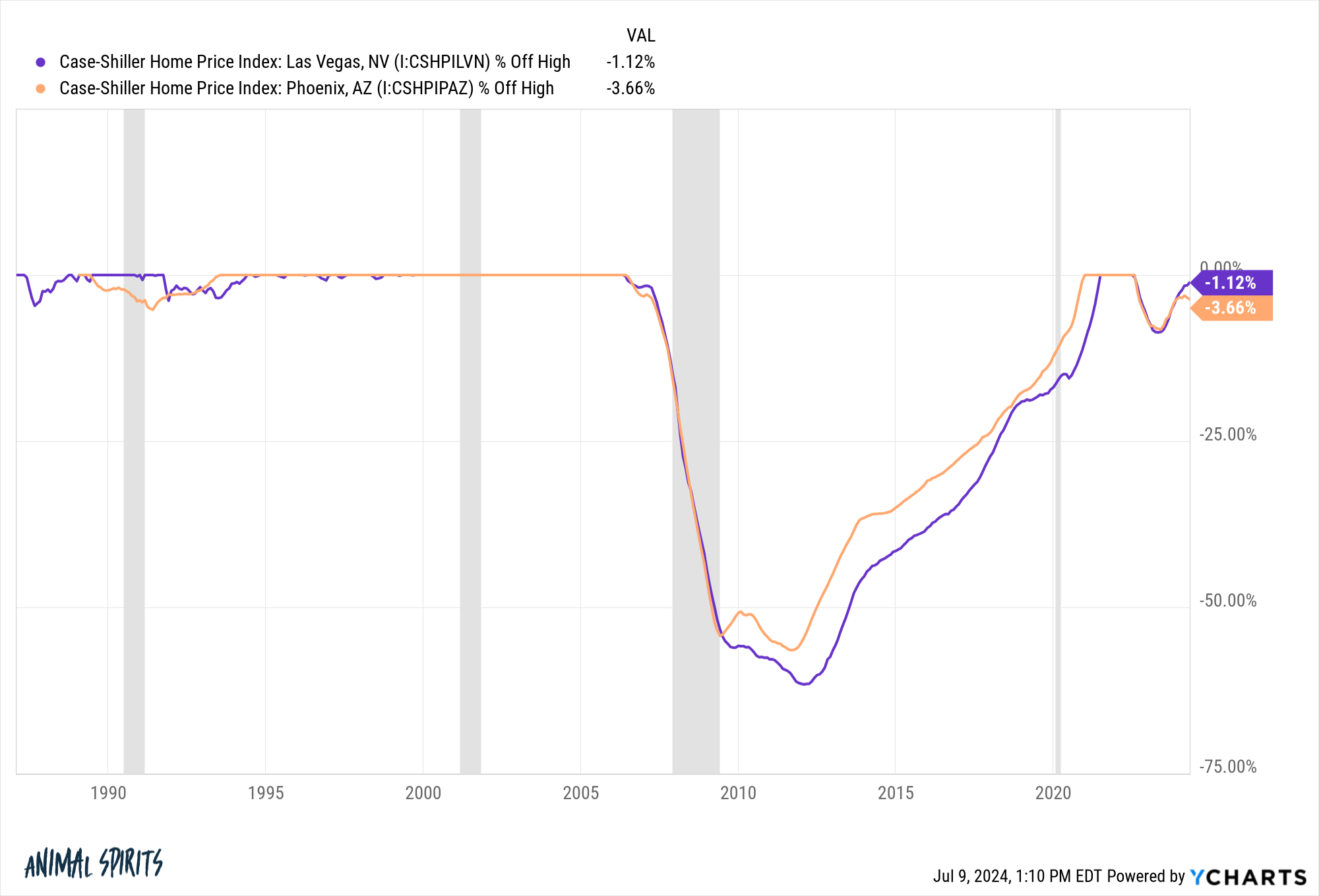

It was even worse in the country’s most modern real estate markets. The cost of housing in Phoenix and Las Vegas has remained low from 2006 to 2020 and 2021, respectively:

There are no positive issues regarding housing costs. The national housing market will probably do well thanks to the remnants of the last decade’s opportunities, certainly local market efforts. Or of course local markets may remain hot despite the national cost effort.

You really have to ask yourself why you’re buying space on the playground in the first place.

Is it purely a monetary asset where you want to earn top value when you return?

Or is a location something that provides a mental source of income to uplift your society, live in a selected community, and serves as a playground for your personal development?

Most people certainly want financial and mental returns, but it’s not a foregone conclusion that your home will be an attractive investment, especially from a stream range.

I believe that our region is a playground to live, have a name for ourselves and raise our children. This acts as an inflation hedge because we now have fixed rate loans and there is not much room for growth in our department. Plus, paying it out over a lifetime creates fairness.

The cost of the house to me does not depend on our skills but on how long we can live there, as long as we want.

A portfolio is where investment returns are at issue.

Home is where return on investment is a profit.

Additional Studies:

The housing marketplace’s disease over time

1Credit score for me.

2Just like if we bought now we would be locking in a profit but would have to pay a higher price for an untouched home.

Discover more from news2source

Subscribe to get the latest posts sent to your email.