Take a look at BYD SEAL 2023 pressure opportunity TeddyLeung/iStock Editorial via Getty Photographs

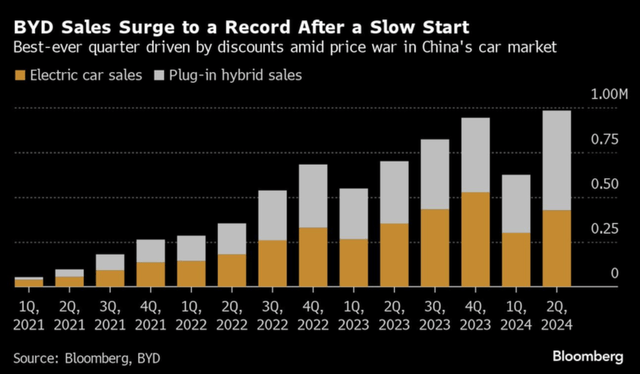

Enter second quarter gross sales numbers from China, which confirmed the emerging dominance of the people’s auto industry and, in particular, BYD (OTCPK:BYDDY) — whose world deliveries Battery-electric automobiles (BEVs) got closer to Tesla.

BYD quarterly gross sales will increase (Bloomberg)

The growing concern in international locations and among existing automakers such as Volkswagen AG (OTCPK:VWAGY) and General Motors Co. (GM) is reflected in the rapid increases in price lists in the US and Europe, aimed at slowing down the rapid growth of the Chinese language. To do. Automotive manufacturers in advanced markets.

For investors, the key challenges are how to enjoy long-term, sustainable growth toward Chinese auto dominance and avoid losses from automakers that would be harmed by the rise of BYD and others. ,

Exactly price?

Looking for alpha valuation chartGM, 5.7, Ford Motor Company (F) 13.3; Stellantis NV (STLA) 2.98; and Toyota Motor Corporation (TM) 8.45. (Tesla’s TTM PE of 67 can be safely considered an outlier) BYD’s profitability, on the other hand, is noticeable among some of the globally dominant automobile producers, Considering Alpha’s Profitability Desk Findings,

BYDDY’s rapid rise occurred from early 2020 to early 2021 when the percentage cost increased from $10 to almost $70. Momentum For three years, the percentage rate has bounced around and ended up in a fairly narrow zone as analysts evaluated the prospects for BYD and alternative Chinese automakers to expand their global footprint. For some time now, signs have been pointing towards more Chinese production through overseas plants, as Japan and South Koreans have done in the past, according to price lists on their vehicle exports.

At this moment, BYD opened its first assembly plant outside China in Thailand, with a potential capacity of 150,000 cars per year. The automaker is also building assembly plants in Brazil (in a used Ford plant) and Hungary, with an additional plant slated for Turkey. The announcement for the Turkish plant comes shortly after the EU announced price tariffs of up to 38% on Chinese auto exports; The EU has concluded that Chinese language-style subsidies are unfairly undermining European competitiveness. BYD cars manufactured in Türkiye will effectively remove the price list applicable to Chinese cars.

Additionally, BYD is reported to be in talks to set up a plant in Mexico.

floating pricing

BYD has demonstrated a versatile pricing technique for its automobiles based on local conditions, which has pleased some customers, angered others. In China, its smallest and lowest-cost BEV sells for less than $15,000; BYD fashion in a foreign country is priced competitively with local producers, yet tariffs still apply. In Thailand, BYD lowered the prices of its automobiles to compliment its disused plant’s outlets, angering some customers who had previously purchased at higher prices.

BYD seals fifth generation plug-in hybrid technology (BYD)

While BYD has previously attracted attention for its low-cost BEV models, it has also developed a powerful experience in plug-in hybrids, which will run entirely on batteries along with an on-board fuel engine – thus The concerns of customers regarding the area will be removed. The automaker’s fifth-generation twin motor hybrid technology will initially be available in China, with a claimed range of 1,300 miles on a full tank of gasoline and a fully charged battery.

BYD has been running on plug-ins since 2008; And its fourth generation setup is nowadays available in Europe as the Sealed U DM-i, costing about $43,000 with a range of about 300 miles in mild weather.

In terms of numbers or positioning, BYD’s market aspirations have rarely been low. Extreme living, the automaker introduced its luxurious sub-brand “Yangwang”, which means “looking up.” The sub-brand’s first offering was its U9 supercar, spotted testing at Germany’s Nurburgring, boasting a 0-60 acceleration of less than three seconds, faster than some German and Italian supercars.

BYD Yangwang U8 Top Class Offroad (BYD)

In September, BYD introduced its U8 luxury rival to the Area Rover and alternative off-road flavored SUVs, priced around $150,000. The plug-in hybrid gadget has a maximum range of more than 620 miles. With a score of 1,200 horsepower, the U8 claims 0-60 acceleration in less than 3.6 seconds.

in short unimaginable

In case of sudden flooding or unexpected deep H2O conditions, BYD claims the car is designed to flow for up to half an hour.

Closer to this life, BYD said it will create its own U7 “electric sedan” that will compete with the Porsche Taycan and Tesla’s high-end BEV. Price: Approximately $140,00. The roof of the U7 includes a pioneering LIDAR feature, suggesting a sophisticated self-driving gadget.

At the other end of the spectrum is BYD’s Sea Lion line, which is designed to compete with Tesla’s popular Style Y – albeit at a significantly lower price. The Sea Lion 7 and Sea Lion 5 forms sell in China for as little as $28,000. The Style Y is priced at around $36,000 in China.

One potential hurdle and likely issue will be the ability of BYD and manufacturers of complex automobiles – which may be filled with complex digital equipment and tools – to pack the information. Cameras, sensors, and optional gadgets can be bundled and send information wirelessly to the manufacturer. Over-the-air updates are sent automatically to keep the tool protected and modern. However, information transmission can also be used by governments for nefarious purposes, such as identifying and tracing the movements of specific vehicles, locating military installations, or disabling vehicles.

Undercover agent concerns

The Chinese are not the only entity that would allow automobiles as espionage tools. This is probably why Tesla cars were banned from some places in China.

There is no doubt that global battery-electric vehicle manufacturers – especially startups – are facing difficult circumstances due to lack of consumer demand for the product. BYD is in a great position to respond with plug-in hybrids until BEVs demand alternatives. Rival BEV manufacturers and startups that do not own plug-ins or have experience with previous, less sophisticated plug-in technology are more likely to suffer losses.

A notable and unanswered question is how soon BYD and other Chinese automakers will enter the US market. Geely has already done this with Volvo, a Chinese brand that works with Swedish characteristics and aesthetics. The Polestar, a second BEV model, may also be manufactured at Geely’s South Carolina plant.

This research assumes BYD and alternative Chinese automakers will likely come to the US as manufacturers later. With President Joe Biden’s urgent note and skepticism about the price list for imports accepted by candidate Donald Trump clouding the political park, the US saw a major re-examination of the timeline for Chinese cars after November. Will be able to go.

Author’s Overview: This newsletter discusses several securities that do not trade on the major changes in the US. Please pay attention to the risks associated with those shares.

Discover more from news2source

Subscribe to get the latest posts sent to your email.