EPFR’s charity flows and allocations data have undoubtedly captured the impact of those shocks, ranging from the 25-week outflow series compiled by the China bond budget in 2H22 to Russia’s moderate allocation to zero among the World Emerging Markets (GEM) bond budgets. till. , However, how has this information fared when it comes to alerting customers to problems ahead of changes in emerging market debt markets?

On this Quant’s Corner, we will be able to look at the possibility of comparative research of active and passive charity observer nation allocations to anticipate those changes. To take action, we’ll look at GEM bond charity allocation data for four countries that experienced large observable changes based on their free and corporate bond markets.

China: pink mark and red ink

In 3Q20, the Chinese government introduced the “Three Red Lines” policy to curb high borrowing and strengthen the financial fitness of the country’s real estate sector. In this policy I have formulated strict lending limits for builders, which include a limit of 70% on liabilities of the property, a limit of 100% on net debt to equity and a cash to temporary borrowing ratio of at least 1.

When mixed with stringent Covid containment policies, the ‘red lines’ drove many core specialty companies out of business and significantly dented domestic consumer sentiment. Many international traders assumed that the federal government would take steps to limit losses to China’s economic system and international collectors. This proved to be a very positive assessment.

Active GEM Bond Charity Managers were the first to reach this conclusion. Their moderate allocation to Chinese bonds fell from 5.68% in March 2021 to 2.72% by March 2023. Meanwhile, the passive allocation remained quite strong despite market volatility ahead of mid-2023.

Investors who reacted to the change in active GEM Charity Manager sentiment in 3Q21 have avoided – or mitigated – the impact of significant underperformance through Chinese bonds in 2022 and again last year.

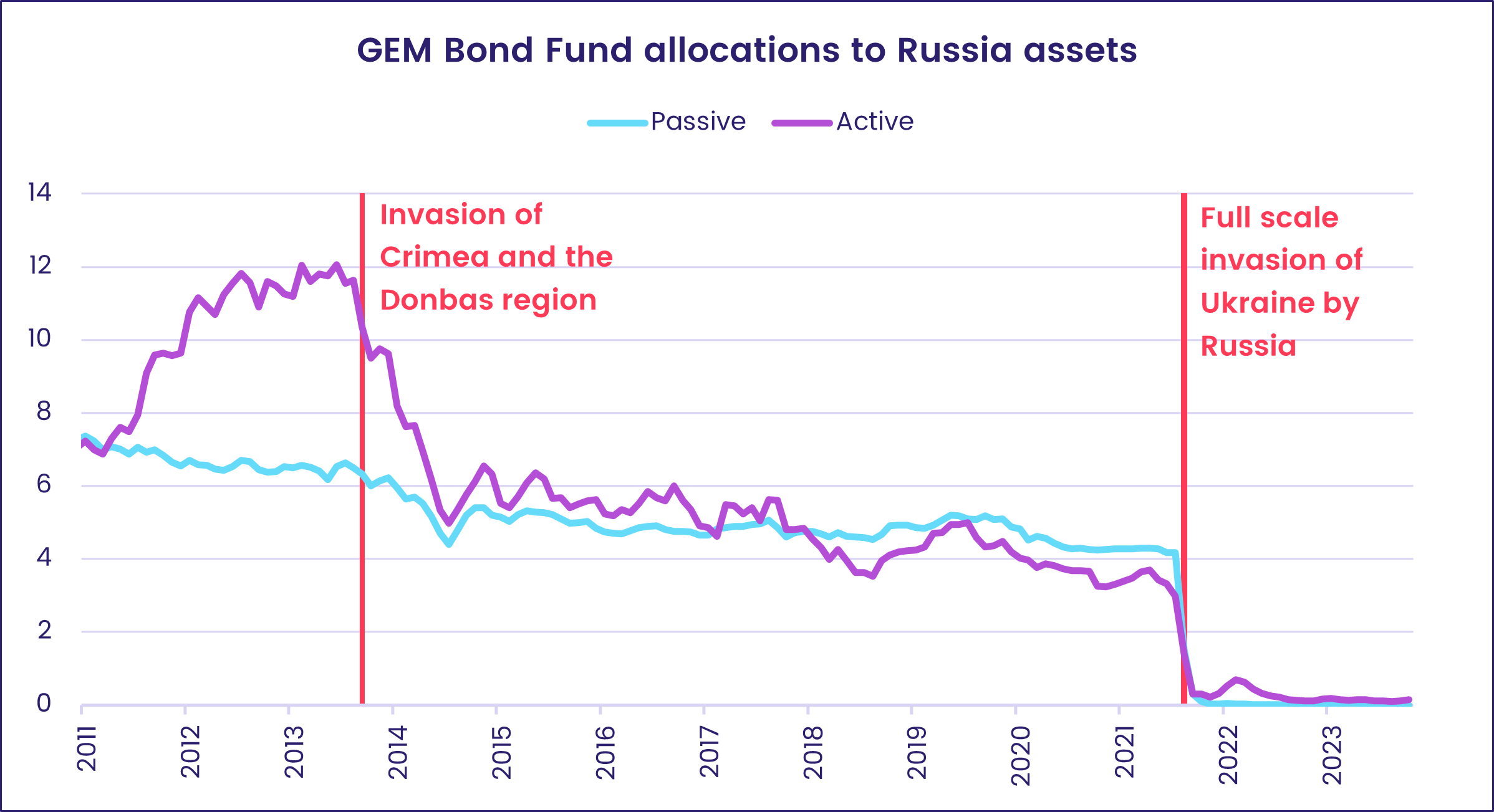

Russia: early detection of the cause

Before Russia’s initial attack on Ukraine in 2014, the active bond budget was largely fat Russian bonds. This self-assurance was once rooted in Russia’s sensual surrender environment and the assumed balance of its monetary apparatus.

On the other hand, after the annexation of Crimea, there were no hidden reductions in active allocations, indicating that managers had reassessed the risks of investing in Russia and determined that they were on top.

In the lead up to Russia’s full-scale invasion of Ukraine in February 2022, active managers took preemptive steps to reduce their exposure to Russian bonds. Despite the fact that the passive budget took largely the same path, in each preceding and subsequent unprovoked invasion, energetic managers sent a more powerful signal that credible threats were increasing.

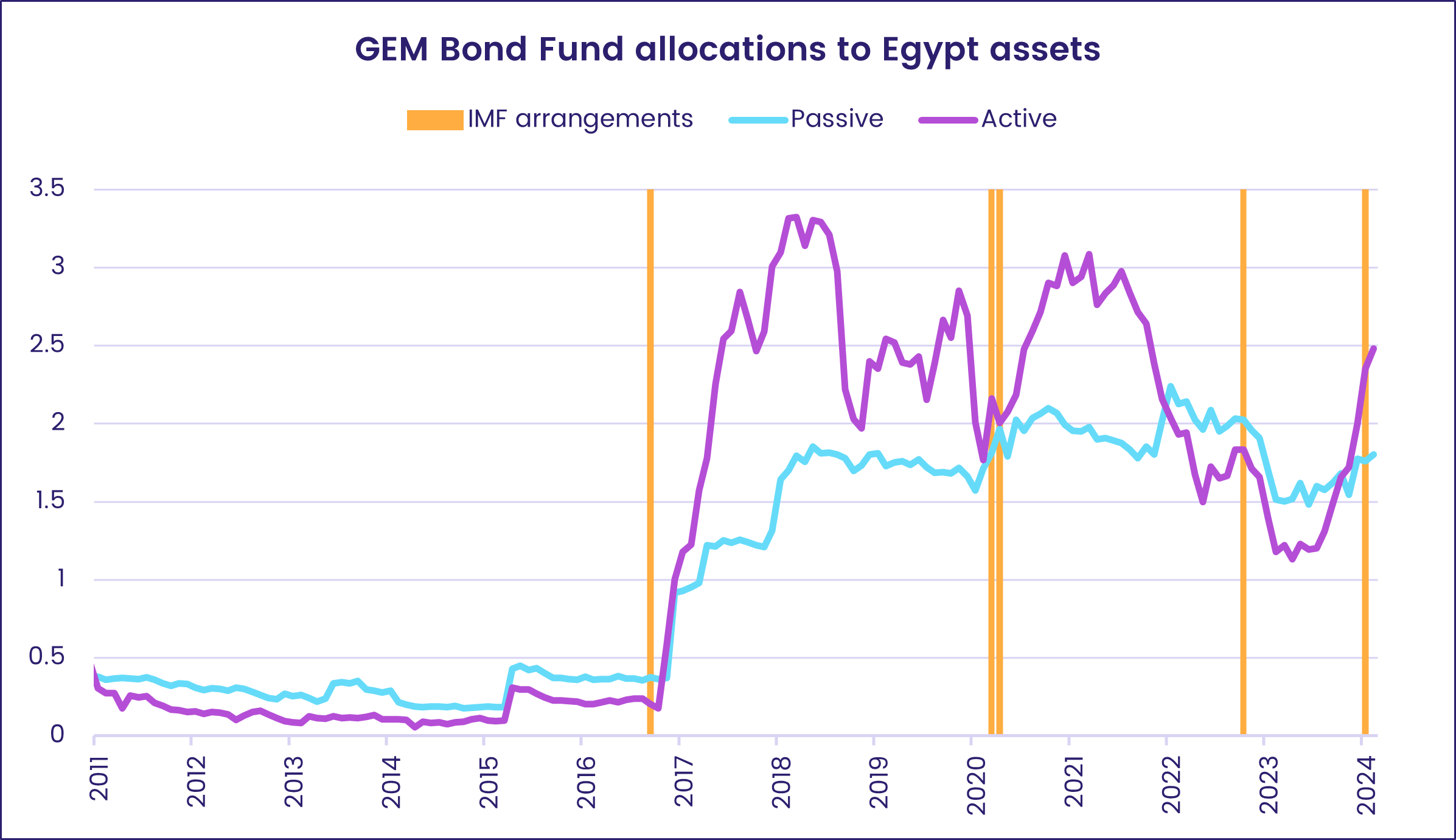

Egypt: According to the script

The first four years of the wave decade have presented Egypt with unfortunate economic and politically challenging circumstances, ranging from high inflation during the closure of the Suez Canal to the ongoing war in Gaza. Those elements – and others – have increased the country’s monetary instability, putting major pressure on the Egyptian pound and executive spending.

Egypt, on the other hand, is no stranger to risky economic conditions and has a history of getting back on its feet with the support of neighbors, the US, and multilateral lenders.

Aware of this well-understood playbook, energetic GEM bond charity managers are adopting an additional reactive solution to Egypt’s promotion, raising it when Egypt is complying with the conditions attached to various rescue programs.

During the de facto emergency, Egypt has once again joined the World Financial Charity (IMF) for financial assistance in exchange for structural reforms. It has also added a significant investment business with ADQ, one of the UAE’s free funding budgets for the construction of the Ras El Hekma Peninsula. In response, the country’s medium allocation among the actively controlled GEM bond budget has increased from 1.72% in January 2024 to 2.48% by April 2024.

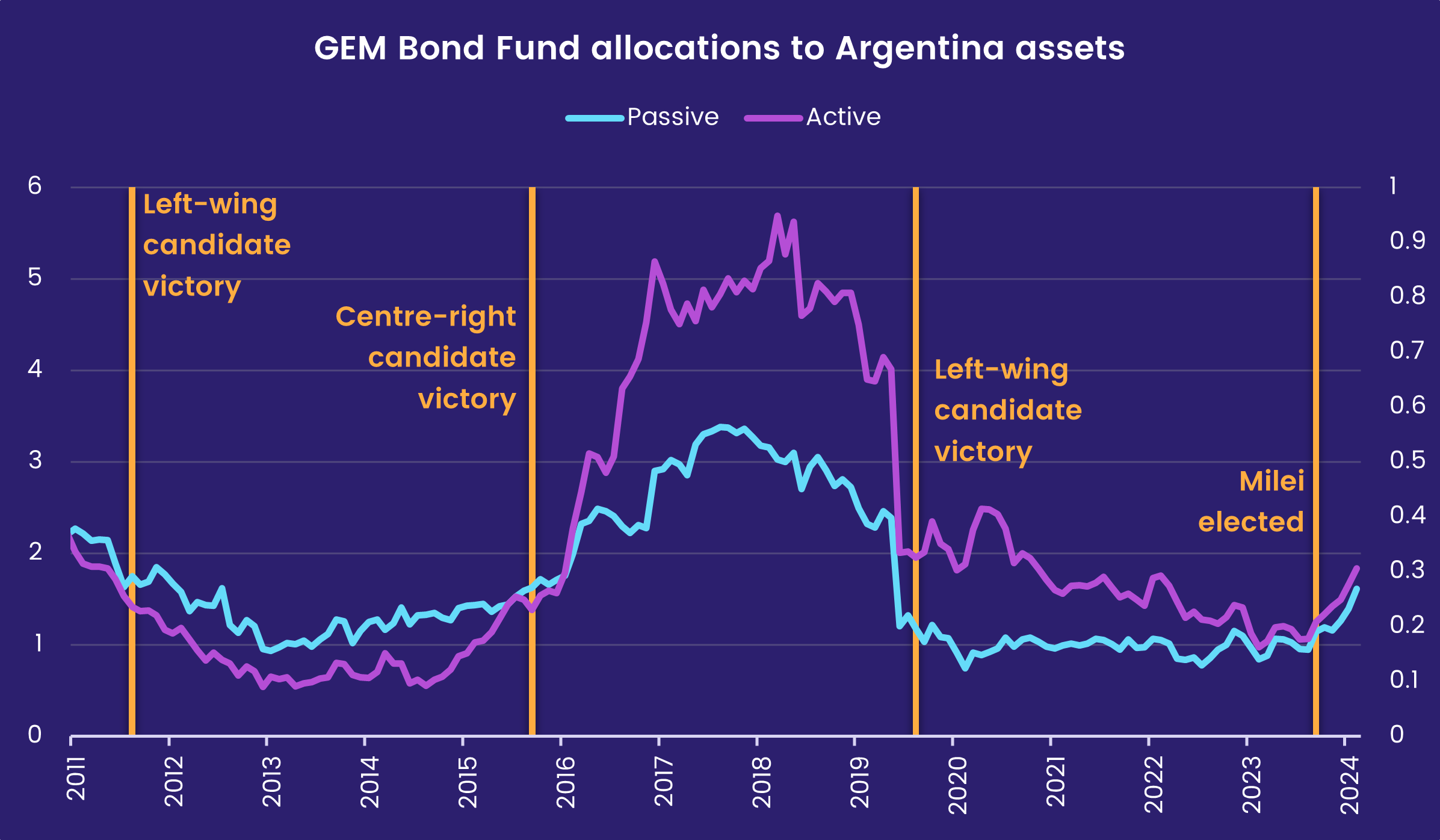

Argentina: remembering old tears

So far this year, sentiment towards Argentina’s equity markets remains at a consistently high level as new President Javier Meli pursues a sweeping fiscal reform program for Argentina.

However the energetic Bond charity manager has been here before, and his contemporary selection suggests he underestimates the chances of Miley’s timetable prevailing compared to Mauricio Macri’s failed attempts between 2015 and 2019.

Argentina faces enormous challenges in stabilizing its economic system, including inflation of more than 140%, a $10 billion underfunding of its foreign exchange book, the possibility of another painful recession, and the burden of a historical past. Including who has seen it by default. That’s 9 times a free loan.

A jewel that needs polishing

Research into the 4 main emerging market debt markets shows that allocation information from actively controlled GEM bond budgets provides useful predictive indicators about market changes. Those indicators provide good insight into market sentiment and early adjustments in outlook.

Alternatively, while allocation information provides some predictive market insight, they are relatively recent and require careful interpretation. The potential to refine those indicators exists, and with additional research, they can be refined into more realistic tools for traders. This growth will be the subject of the year’s analysis in EPFR’s Quant Corner.

Did you find it useful? Get our EPFR insights delivered to your inbox.

Discover more from news2source

Subscribe to get the latest posts sent to your email.