In a seminal analysis, Tommaso Cracioli and Toon Van Overbeke found that small business owners and their families, who have lost income percentages to the emerging market focus among entrenched companies, turned to far-right political parties to express their grievances. went.

How do market forces affect prosperous democracies? For capitalist democracies to be sustainable, they must encourage self-confidence among voters that markets can deal with honest choices and rewarding financial prospects. On the other hand, the market doesn’t always work that way. In late nineteenth-century America, Louis D. Brandeis helped lead an intellectually populist campaign against monopolies, above all that of General Oil, which had come to dominate the economy during the “Gilded Age”. This antitrust sentiment led to America’s first antitrust regulation, the Sherman Act, in 1890, which helped rebalance the financial system in favor of smaller companies.

In France in the nineteen-fifties, the populist Poujadist movement similarly exploited the business grievances of small shopkeepers against the federal government’s pursuit of financial globalization and industrialization. The Poujadists claimed that small companies and artisanship were the only means of advancement for the general population, and that those paths were now being pressured by the company and commercial elite of Paris and the family.

The grievances of small business owners in the face of emerging market forces amid deep competition remain a priority in most democratic societies. Contemporary evidence suggests that festivals are declining in the US and other regions of the world. Consistent with this literature, a combination of globalization, virtual innovation, and tacit antitrust enforcement has enabled giant corporations to monopolize markets and outperform smaller competition. More recently, those views about the deteriorating festival were supported by Neo-Brandeisians who, like their namesake, consider giant businesses a financial and political threat. In Europe, similar ideas about the ability of local enterprises to compete in twenty-first century capitalist markets have fueled neo-Pouzadist elements of the French yellow-vest movement.

Despite much community consideration of how much a large market focus harms small business and self-governance, academics have paid little attention to how small companies respond politically to a market focus. Our analysis answers this question by studying the political behavior of small business owners and their families in Europe in the face of increasing market power. Mini-industry owners, such as local butchers, continue to play an important role in modern societies. Mini companies comprise about 93% of non-financial companies in Europe and employ about 30% of the workforce. Thus, these companies play a very important role in stimulating local and nationwide economies and promoting local communities. Small business homeowners also make up a core part of the middle class in Europe, and thus consistently underpin centrist, average events. If the market power of larger businesses is increasing at the expense of smaller companies, we are expecting this to reflect dissatisfaction among some of the stakeholders of closure: landlords, families, employees and the local communities who depend on them. This is potentially capable of bringing about brutal change from existing centrist parties and in opposition to parties at the extremes of the ideological spectrum.

Emerging market focus hurts small business

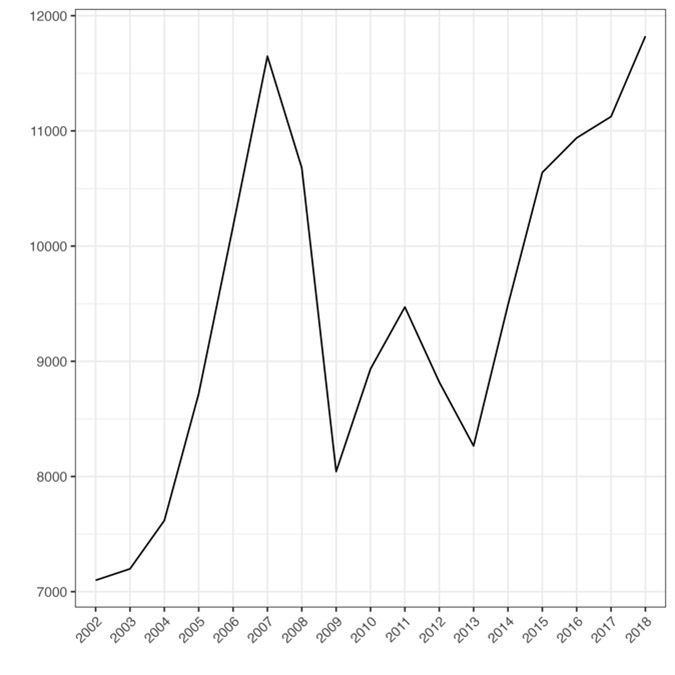

Our research begins by evaluating how much small companies (defined as corporations with fewer than ten employees) contributed to regional industries (defined using NACE 2-digit codes) from 2002-2018 and their impact on mergers and acquisitions. A series of acquisitions experienced in each future in this same current period. 1A presentations show that the average income percentage of small companies in the regional industry has fallen by about 6% since 2002. The EU debt emergency of 2009–2010 accelerated this development. However, two issues are worth emphasizing. First, the adverse developments began before the debt emergency. Second, smaller companies never regained their market share and continued to grow downwards.

Turning our attention to Panel 1B, we can see that the accumulation of mergers has remained stable from 2002 to 2018. The economic emergency of 2008 halted this development. However, merger work began to climb once again in 2013 and regained its work peak by 2018.

set 1, Percentage of revenues of mini companies within the regional industry (1a) and the collection of future corresponding mergers (1b)

A) sector-industry revenue percentage of mini companies B) future-oriented mergers

The next step in our analysis was to determine a more powerful relationship between merger activity and the business efficiency of small firms for 14 Western European countries. We found that the firm-level regional income percentage of small companies fell by 10-13%, followed by an increase in market focus equivalent to 1145 points of the HHI index due to M&A. Furthermore, the probability of those smaller companies exiting the market in merger action increased by 7–9%.

Distressed small business homeowners and families take a sharp right turn

When we established an adverse relationship between merger jobs and small business jobs, we explored what impact the closure’s losses had on the electoral arena. Using individual-level knowledge on small business homeowners and their population contributors, we first document that homeowners and their families are 19-25% more likely to move away from existing developments due to mergers leading to improved market concentration. becomes more like 9-13%. More likely to vote for non-incumbent far-right parties. We do not find that this market focus effect encourages homeowners or households to vote for leftist parties.

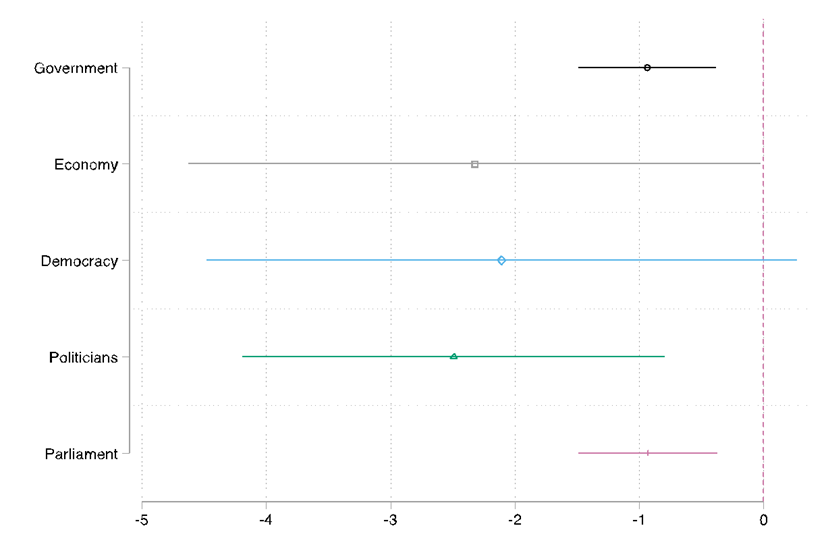

How are we able to explain this tendency to vote for far-right parties? First, in-depth analysis on various financial shock presentations shows that some distance right is particularly a hit in attracting voters who enjoy or worry about poor socio-economic status. In most societies, small business owners and their families depend on their corporations not only as a source of income but also as a source of social status. Second, we know from prior work that voters with low or declining levels of trust in key democratic institutions are more likely to admire political parties, such as far-right parties, that challenge established political norms. Whether due to belief in government economic disasters or outright capture of company interests, it is therefore likely that small industry owners and their families express grievances by supporting political parties that challenge existing institutions. By way of countering this situation, the agenda of the radical right parties seeks to respond to small business owners as well as provide coverage against offenders such as globalization. In Determination 2, we provide evidence of this growing institutional distrust. We believe that the expansion of mergers reduces the acceptance of small business owners and population contributors in the financial system, federal government, self-government, politicians, and parliament.

Determine 2. The impact of high-concentration expansion mergers on individual-level attitudes.

Note 2: For example, the “Parliament” estimate shows that for landlords and members of the population of small companies in industries experiencing mergers, their recognition in Parliament is approximately the same level as for landlords and the population. Has decreased. Contributors are no longer experiencing the merge.

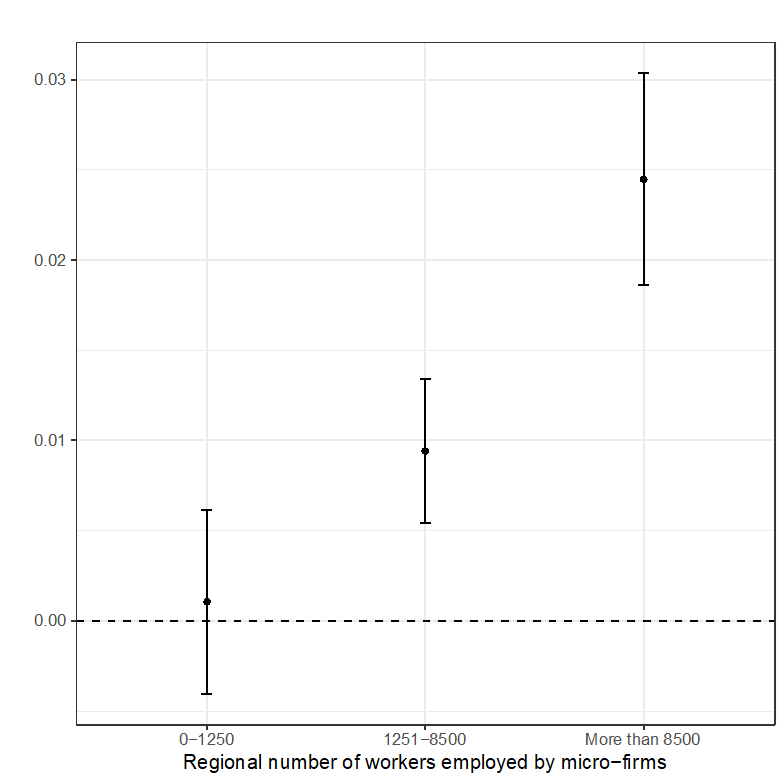

We additionally examined how individual-level mechanisms exert constituency-level electoral effects in nationwide elections. Our research shows that a 5.1% reduction in the percentage of regional revenues transferred to small companies increases the vote percentage of non-outgoing far-right parties by 12 share points. This effect increases with the general accumulation of population employed by small companies in an area.

Determine 3. The impact of the declining regional financial burden of small business on non-emergent radical right incidence, vote stock through the population hired through small business within the region

conclusion

To conclude, we demonstrate that market expansion has been an important driving force behind political fragmentation and the recent shift toward far-right populist phenomena. Our findings echo arguments made by Francis Fukuyama Liberalism and its discontents, Through which he began to question the democratic implications of financial consolidation driven through the pursuit of affordability, which resulted in the closure of small companies and the deregulation of large companies.

The tension of capitalism has often been expressed as a goal between capital and labor. Lately, it’s usually between small and giant companies. In both the US and Europe, governments are implementing commercial policy to create national champions that can compete in the world market. Our analysis highlights every other strain on this technology for prosperous democracies.

The articles constitute criticisms of their authors, and not necessarily of Chicago College, Sales College of Trade, or its school.