Manage 10 Undervalued Stocks Based on Money Flow in India

|

identify |

wave value |

true value (estimate) |

Price cut (estimated) |

|

Updater Services and Products (NSEI:UDS) |

₹290.60 |

₹476.83 |

39.1% |

|

IOL Chemical Compounds and Prescription Medicines (BSE:524164) |

₹405.10 |

₹574.52 |

29.5% |

|

Vedanta (NSEI:VEDL) |

₹454.05 |

₹634.93 |

28.5% |

|

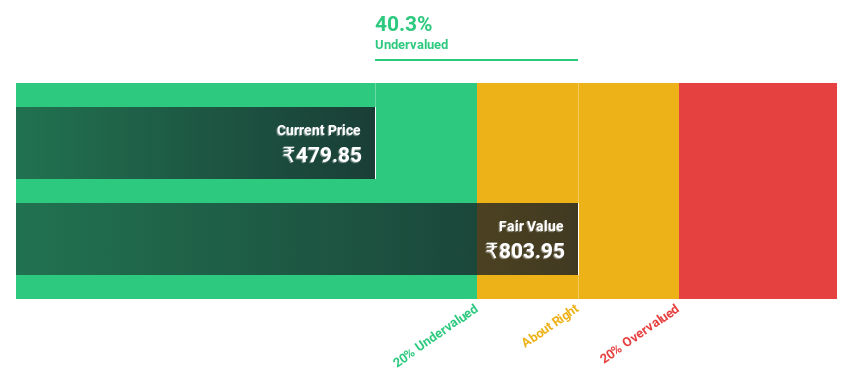

Mahindra Logistics (NSEI:MAHLOG) |

₹490.55 |

₹801.82 |

38.8% |

|

Strides Pharma Science (NSEI:STAR) |

₹947.00 |

₹1520.38 |

37.7% |

|

TV18 Broadcasting (NSEI:TV18BRDCST) |

₹41.94 |

₹69.93 |

40% |

|

PVR Inox (NSEI:PVRINOX) |

₹1428.10 |

₹2224.30 |

35.8% |

|

Delhivery (NSEI:DELHIVERY) |

₹395.95 |

₹610.04 |

35.1% |

|

Camlin Fantastic Sciences (BSE:532834) |

₹106.93 |

₹155.94 |

31.4% |

|

Godrej Homes (NSEI:GODREJPROP) |

₹3077.20 |

₹4584.15 |

32.9% |

Click here to see our complete list of 18 undervalued Indian stocks based on the Money Flow Screener.

Let’s discover the many extraordinary options from end to end of the screener

Review: Mahindra Logistics Limited operates as a supplier of built-in logistics and mobility solutions in India and across the world, with a market capitalization of approximately ₹35.34 billion.

Operation: The company basically generates income through two segments: Supply Chain Control, which contributes ₹51.78 billion, and Project Mobility Services & Products, which contributes ₹3.28 billion.

Estimated cut price to actual price: 38.8%

Mahindra Logistics (₹490.55) is trading at a substantial discount, valued at 38.8% below its estimated fair value of ₹801.82, indicating potential undervaluation in line with the discounted money stream study. Despite fresh financial struggles, including a net loss reported this autumn 2024 and throughout the day, the company is projected to grow earnings 61.09% annually over the next 3 years, which will exceed moderate market expansion expectations. On the other hand, its dividend safety is overstretched and the burdensome bills are poorly offset by earnings, indicating some monetary drive despite constructive expansion projections and strategic expansions, such as warehousing and trucking services in Republic. and a new three-way partnership with Seno Holdings for products. Of India.

Review: PVR Inox Limited operates as a theatrical exhibition company in the Republic of India and Sri Lanka, specializing in the exhibition, distribution and production of films, with a market capitalization of approximately ₹140.13 billion.

Operation: The company earns mainly through film screenings, which contributed ₹60.71 billion, with supplementary income from homogeneous sectors accounting for ₹3.17 billion.

Estimated cut price to actual price: 35.8%

PVR Inox, trading at ₹1428.1 today, looks over 20% undervalued against its par value estimate of ₹2224.3 in line with discounted cash flow projections. Despite new expansions and strategic alliances improving its operational footprint, the corporate’s monetary efficiency exhibits a tough stretch with a significant relief in web loss, but unprofitability persists. Expected to prove successful within 3 years, PVR Inox’s earnings growth is estimated at 11.3% annually, well above the market average, suggesting the potential for drug and price recovery within moderate expression.

Review: Vedanta Limited is a diversified herbal resource company involved in exploration, extraction and processing of minerals and oil and gasoline, operating in the Republic of India, Europe, China, USA, Mexico and other global markets with a market capitalization of approximately ₹1.68 billion. Is. Trillion.

Operation: Corporate earnings were basically generated from Aluminum (₹48.37 billion), Zinc – Republic of India (₹27.93 billion), Copper (₹19.73 billion), Oil and Fuel (₹17.84 billion), Energy (₅6.15 billion), Iron it occurs. Ore (₹9.07 billion), and Zinc – World (₹3.56 billion).

Estimated cut price to actual price: 28.5%

Vedanta Ltd., with a flow trading rate of ₹454.05, is located below the estimated fair value of ₹634.93, indicating potential undervaluation in line with the discounted money stream study. Despite posting a dividend of 4.85%, its security through revenues remains weak. Corporate debt relief efforts continue, with plans to shed an additional $3 billion in Vedanta assets over 3 years. The contemporary strategic move comes with the approval to raise Rs 10,000 million through non-convertible debentures and the intention to monetize its metal industry if market conditions are favourable, with an aim to successfully supersede the debt limits. Appropriate pricing has to be determined.

key takeaways

-

Get an in-depth view on all 18 undervalued Indian stocks based on money flow using our screener here.

-

Did these shares give you skin in the game? Learn how to increase your dominance over them through the use of Merily Wall St’s portfolio, where intuitive tools are in place to help optimize your funding results.

-

Strengthen your investing skills with the Merly Wall St app and enjoy access to vital market knowledge spanning every continent.

Looking for additional options?

Via Merily Wall St. This newsletter is general in nature. We only render commentary using an unbiased approach consistent with historical data and analyst forecasts and our articles are not meant to be financial advice. It no longer represents advice on purchasing or promoting a book, and no longer takes account of your goals, or your monetary situation. We strive to provide you with long term targeted research through basic information. Be aware that our research will not be released within the original price-sensitive corporate bulletin or qualitative content. Merrily Wall St has a negative position on any of the stocks discussed.

The firms mentioned in this article come with NSEI:MAHLOG NSEI:PVRINOXNSEI:VEDL and.

Does this article have comments? Regarding the content included? Contact us without delay. Alternatively, email editorial-team@simplywallst.com

Discover more from news2source

Subscribe to get the latest posts sent to your email.