If that’s the case, don’t let yourself be discouraged – you’re in excellent company. You are still some distance away from falling into financial trouble. Even if you may not be able to turn the year around and recapture the overlooked option, there is still a lot more to look forward to for long-term investors.

If you want to make sure you don’t miss the nearest huge rapid, however, chances are you’ll want to change your technique a bit. This year, you’ll likely find it difficult to buy fewer stocks and focus more on exchange-traded budgets (or ETFs), which may be easier than regular ones to stay afloat in a difficult situation for the overall market.

On that note, here’s a better look at three other ETFs that you can be confident buying that — combined — complements your portfolio brilliantly.

Start with the Basics: Dividend Growth

Most traders sensibly prioritize growth, choosing growth stocks to meet this objective. And the method works normally. On the other hand, what most true long-termers probably won’t care about now is that they may be able to get the same kind of net returns with uninterested dividend-paying stocks as with stocks held in Forefront Dividend Esteem ETF (NYSEMKT:VIG) which reflects S&P US Dividend Growers Index,

As the name suggests, this is a frontier charity and its underlying index accumulates shares that not only pay normal dividends, but they also have a track record of normal dividend growth. To be included in the S&P US Dividend Growers Index, an organization must increase its dividend annually over at least 10 years. On the other hand, generally, they have done so by some distance.

The Wave Dividend Turnover of the ETF is a little less than 1.8%, which is certainly not exciting. In fact, it’s so low that investors may be wondering how this donation correlates with the broader market, let alone growth stocks. What’s been grossly underestimated here is the massive dividend growth potential of those stocks. In the process of 10 years, its per-share payout has more or less doubled, and has more than tripled from what it was billings 15 years ago.

This is because most stocks paying stable dividends to do Outperform your non-dividend paying friends. Volume-crunching done by Mutual Charity Company of Hartford shows that since 1973, S&P 500 stocks with long histories of dividend increases boast an average annual return of just over 10%, in contrast to a much more negligible annual gain of 4.3%. We do. % for non-dividend payers, and contrasts with a median annual return of only 7.7% for the equally weighted model of the S&P 500 index. The numbers ensure that there is a lot to mention for a decent, consistent source of revenue.

Next Upload Tech-Driven Capital Idealizes

That being said, there’s no clear explanation for why your portfolio can’t be a little more explosive with dividend-oriented holdings. If you can handle the volatility that is sure to continue, take a stake in Consider Invesco QQQ (NASDAQ: QQQ),

This is according to the Invesco ETF (regularly known as “Cubes” or Triple-Q). Nasdaq 100 Index. In most cases, this index is made up of 100 nasdaq compositeThis is the largest non-financial list in any year. It is updated each quarter, even if there are cases of closing imbalances that may recommend an unscheduled rebalancing of the index.

However this in itself does not make this donation a must for a lot of investors. As it also happens, most of the highest-growth generation companies choose to list their stores nasdaq accumulation optional In return just like alternative exchanges Unused York Cache Alternative Or American savings alternative, name like Apple, MicrosoftAnd NVIDIA These aren’t the only Nasdaq-listed tickers. They are also the government holdings of this ETF Amazon, meta platformand google mom or dad Alphabet, After all, these have been the most profitable stocks in the market for the last several years.

This will not always happen. Just as companies like Nvidia and Apple forced alternative names out of the index to make room for their shares, those Wave Control names may also be displaced by alternative names in the future (even if that happens before that happens. is likely to be the date of ). This is simply the proverbial cycle of market age.

On the other hand, this displacement will likely be carried out through and as a result of the generational firms behind game-changing services and products. Protecting a stake within the Invesco QQQ Considera is a simple, low-maintenance option to ensure you have at least the maximum invested in their shares in an excellent year.

Don’t forget about indexing, although fight in a different way

Last but not least, although Triple-Q and Forefront Dividend Esteem Charity are simple techniques for diversifying your long-term portfolio, good old indexing techniques also work. This means being satisfied with the long-term performance of the broader market index, rather than the possibility of it underperforming the market by trying to beat it.

Most traders will go towards the same thing Consider the SPDR S&P 500 ETF (NYSEMKT:SPIES), which ultimately mirrors the S&P 500 large-cap index. And if you’ve already made it private, that’s appreciated – keep it going.

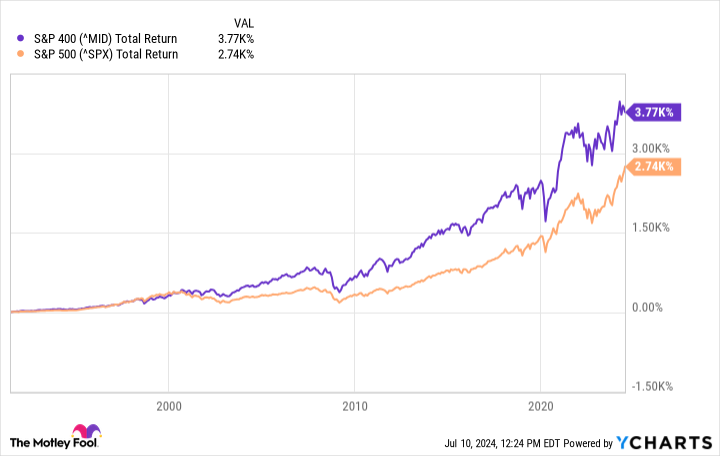

If and when you’ve got some lazy money to put to work, think about moving straight into a mid-cap charity such as iShares Core S&P Mid-Cap ETF (NYSEMKT:IJH) rather. Why? Because you are likely to do better with this ETF than a large-cap index budget. Age exceeded 30 years in this process S&P 400 Mid-Cap Index Has significantly outperformed the S&P 500.

In truth, unequal levels of beneficial properties are understandable. Look, while no one to this day disputes the strong foundation on which most S&P 500 companies are built, in some ways they are victims of their own size – it’s hard to get bigger when you’re already overwhelmed. This is in contrast to the medium-sized companies that comprise the S&P 400 Mid Cap Index. Those organizations have had difficult and tumultuous early years, and are just entering their high-growth era. Now they will not all be on this segment, although the companies would like to complex microscopic units And awesome micro laptop He to do Live On ultimately proved to be extremely profitable for its influencer shareholders.

Should you invest $1,000 in iShares Consult – iShares Core S&P Mid-Cap ETF right now?

Before you buy into iShares – Consider the iShares Core S&P Mid-Cap ETF, believe this:

Motley Fool Idiot Marketing Consultant The analyst group simply identified what they believe 10 perfect shares For investors to buy now… and consider iShares – iShares Core S&P Mid-Cap ETF was not one of them. The ten stocks which fell may give great returns in the coming years.

imagine when NVIDIA This list was created on April 15, 2005… If you invested $1,000 in a year according to our advice, You will have $791,929,

Sancha Marketing Consultant Offers investors an easy-to-follow blueprint for good fortune, including guidance on developing a portfolio, regular updates from analysts, and two untapped store options in every generation. Sancha Marketing Consultant the carrier has more than quadruple S&P 500 returns since 2002*.

View ten shares »

*Withdrawal of Sanchay Marketing Consultant by July 8, 2024

John Mackey, former CEO of Entire Meals Marketplace, a subsidiary of Amazon, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, former director of marketplace construction and Facebook spokesperson, and sister of Mark Zuckerberg, CEO of Meta Platform, is a member of The Motley Fool’s board of administrators. Suzanne Frey is a member of the board of administrators of The Motley Fool, a government arm of Alphabet. James Brumley holds positions at Alphabet. The Motley Fool has positions in and recommends Complicated Micro Units, Alphabet, Amazon, Apple, Meta Platform, Microsoft, Nvidia, and the Forefront Specialized Price Range – Forefront Dividend Esteem ETF. The Motley Idiot recommends Nasdaq and refers to options: long a January 2026 $395 short on Microsoft and a long January 2026 $405 short on Microsoft. The Motley Idiot has disclosure coverage.

Ignored in the bull market fix? 3 ETFs to backup the wealth you’ve built over many years. First published via The Motley Idiot

Discover more from news2source

Subscribe to get the latest posts sent to your email.