Munis outperformed US Treasuries on Friday in holding steady as the government saw some losses and equities were also in the red after May, with data coming in on a larger than expected personal intake, leading to a Federal Reserve strike. The expected momentum became stronger. This is the first American presidential debate in a generation.

As for the former, “PCE inflation is falling slowly, but it is still above the Fed’s 2% target,” research into the May PCE inflation wisdom of renowned Mercatus Middle macroeconomist Patrick Horan. “I would not expect today’s data release to change the Fed’s thinking on interest rate cuts. Right now, we should not expect an interest rate cut before September.”

John Kershner, head of US securitized merchandise at Janus Henderson Byers, said the market is now “giving the Fed the green light to consider a rate cut at its September 18 meeting.” “While Federal Reserve officials may remain on message in the coming weeks saying they are ‘data dependent,’ we will be watching to see if they try to talk down these rate cut expectations Or perhaps even strengthen them.”

“We still have two rounds of inflation data before that meeting, and it looks more likely that the slower inflation data will give the Fed cover to start cutting rates later this year,” Kershner said.

Markets have been less reactive to Thursday’s headline-driving debate between President Joe Biden and former President Donald Trump.

“The American electorate remains polarized, and we expect to see considerable discussion about whether investment portfolios should be reexamined,” said Solita Marcelli, US-based funding officer at UBS International Wealth Control. “But we believe that suddenly adjusting one’s long-term financial plan in the wake of a single debate has its own risks, and could ultimately prove counterproductive.”

What may have a greater impact on the public finance industry, at least in closer terms, are the U.S. Splendid Court decisions passed to date, which found that the Securities and Exchange Commission had the advantage of administrative court complaints in those cases. Can’t pick up where it wants civil results,

There are alternative SCOTUS selections to check out Loper Glorious Enterprises v. Raimondo and Relentless, Inc. vs business segment, Which ruled in opposition to the so-called Chevron Doctrine which allows federal companies to rely on their own laws and interpretations.

Strategists at Barclays PLC noted that for finance-focused people, Treasury giveaways have increased “meaningfully” in the market to date, due “mostly to the heavy auction, as well as the yen’s decline since the mid-1980s.” “fall to the lowest level”. In a weekly record. “Tax-free income has largely become in line with the UST.”

On the other hand, BofA International Analysis strategists noted in a weekly report that the muni marketplace “successfully pushed through a heavy primary market in June, with the muni to Treasury ratio remaining relatively tight.”

Definitely,

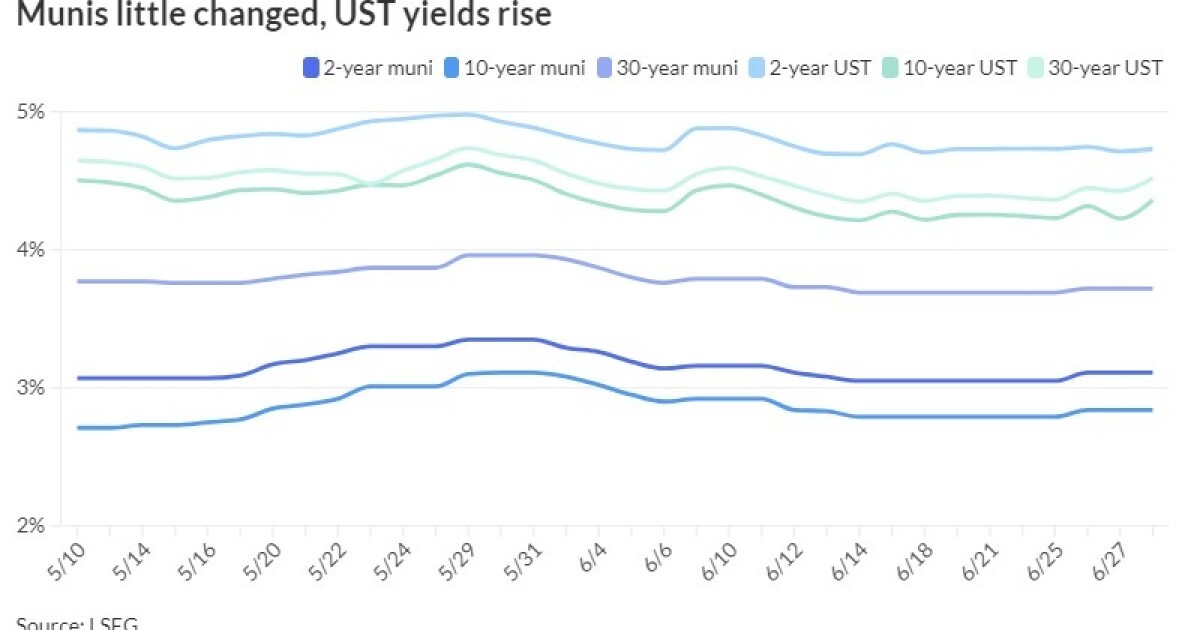

After Friday’s strikes, the ratios were little changed, with the two-year muni-to-Treasury ratio at 66%, the three-year at 66%, the five-year at 67%, the 10-year at 65% and the 30-year muni at 65%. -Treasury ratio. -year at 84%, according to a 3 p.m. EST study from Refinitiv Municipal Marketplace Knowledge. At 3:30 pm in ICE Knowledge products and services, retention was 66% at two years, 67% at three years, 68% at five years, 68% at 10 years and 84% at 30 years.

“As we enter July, supply/demand dynamics will experience a sharp shift in favor of bond investors,” BofA strategists Yingchen Li and Ian Rogo noted.

BofA expects to issue $37 billion of its latest long-term bonds in July, “which exceeds the $65 billion of original redemptions and coupon payments,” he noted. “We view the muni market’s current hesitation as a good opportunity to enter positions ahead of our expected 100-basis-point rally in 2H24.”

Barclays expects the July issuance to be within the middle department of at least $30 billion, additionally noting that July is the most important redemption moment this summer season, “and not only in the high grades; Puerto Rico. The redemption should be closer to $1.5 billion,” noted strategists Mikhail Fox and Claire Pickering.

He believes technicals should be supportive for the market in early July, “even if yields continue to rise as we expect and rate volatility continues.”

Despite the selloff to date, Treasury giveovers in June have been unhealthy for 20 basis issues, “which has helped the muni market,” Barclays said.

He noted that the higher-rated BBB once again outperformed, although AAA also performed well, “although they are still in the red for the year.” He said the unmarried-A and double-A portions of the market have underperformed this time.

Returns as of Friday morning for the Bloomberg Municipal Index are displayed in red at 1.51% for the year to June and -0.43% for 2024. Top-yield, on the other hand, returned 2.46% in June and 4.15% in 2024. Up to this point. Taxable munis are +1.59% in June and +0.45% in 2024.

aaa scale

The Refinitiv MMD scale used to be unchanged: only 3.15% in one year and 3.11% in two years. At 3 pm it used to be 2.88% on five years, 2.84% on 10 years and 3.72% on 30 years.

The post ICE AAA curve was slightly changed: 3.19% in 2025 (untested) and 3.11% in 2026 (untested). The five-year was 2.92% (uncharted), the 10-year was 2.88% (uncharted) and the 30-year was 3.72% (flat) at 3:30 PM

The S&P International Marketplace Perceptions municipal curve was unchanged: 3.17% in single-year 2025 and 3.11% in 2026. It was 2.88% in five years and 2.88% in 10 years. At 3 pm it was at 2.88% and 30-year post was at 3.70%

Bloomberg BVAL used to be unchanged: 3.17% in 2025 and 3.12% in 2026. 2.93% in five years, 2.84% in 10 years and 3.73% in 30 years at 3:30 pm

The treasury has become weak.

2 year UST was at 4.726% (+1), three year UST was at 4.522% (+3), five year at 4.341% (+4), 10 year at 4.355%. (+7), 20-year 4.616% (+8) and 30-year 4.514% (+9) at 3:40 pm

Discover more from news2source

Subscribe to get the latest posts sent to your email.